Staking with Ethereum 2.0

- Through the transition to Proof of Stake ETH can now be staked.

- For this purpose, ETH are bound in a staking contract, which ensures that stakers (also called validators) adhere to the consensus rules when generating the blocks. Otherwise, they could be lost.

- In return, the staker receives a reward in the form of newly created Ether (ETH).

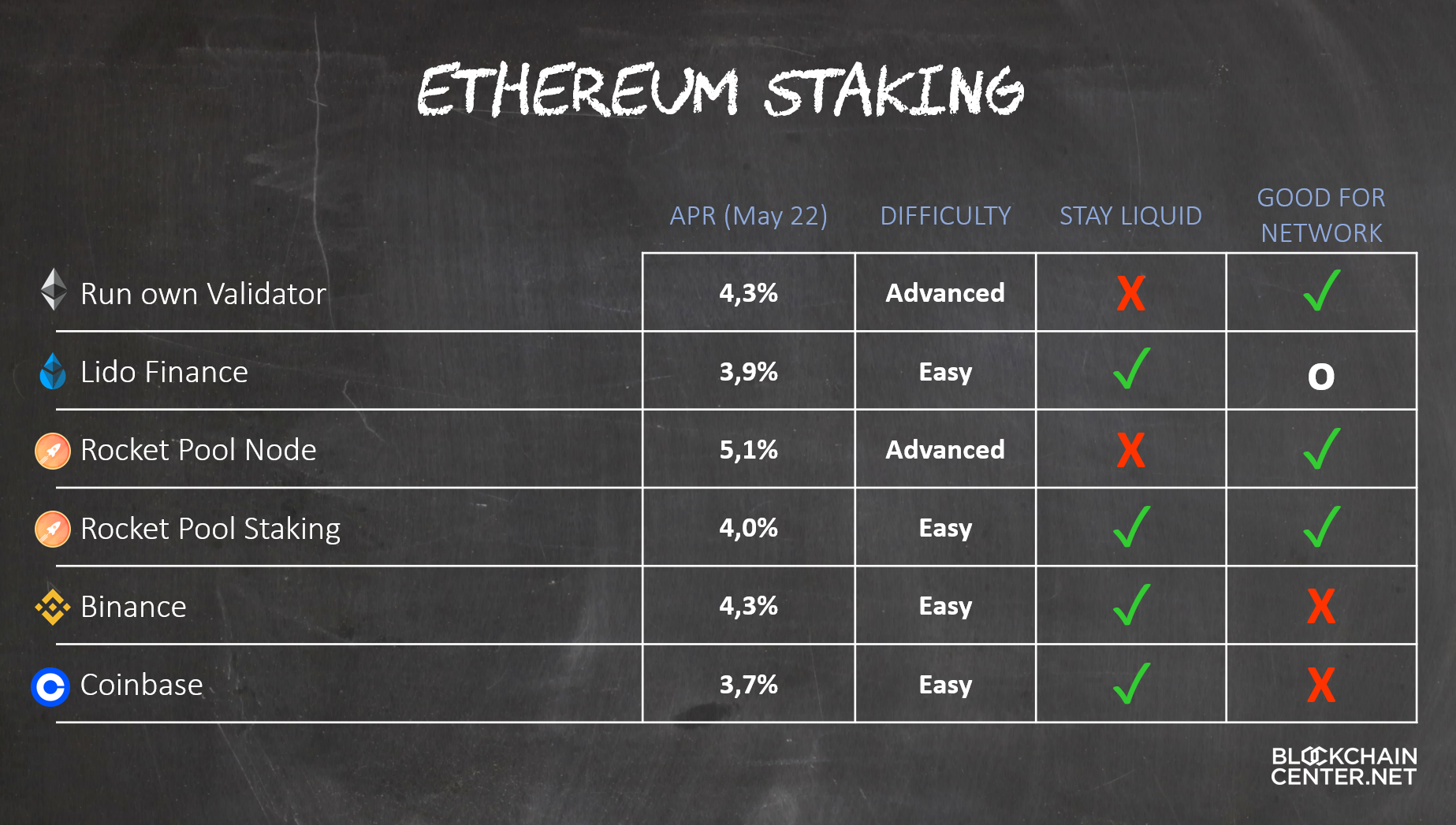

- For stakers, this means a return (currently just under 5%) on their deposit and this depends on how many stakers there are in total.

- The Ethereum 2.0 Launchpad guides through the relatively complicated process of becoming a validator.

- Recommendation: it is easier to go with providers that take care of the technical side and only require the deposit. We recommend Lido Staking for this purpose.

Quick Start: Ethereum Staking with Lido

- Buy ETH on Bitvavo (if you don’t already have any).

- Pay out ETH from exchange to MetaMask wallet.

- Visit https://stake.lido.fi/ and connect your wallet (‘Connect Wallet’)

- Enter the desired amount in the form.

- Confirm the transaction in your wallet.

You will immediately be entitled to a part of the revenue Lido generates through Staking. Bonus: The Ether is blocked, but in return you receive the same amount in stETH (Staked Ether). stETH usually has the same value as ETH and can be regularly used.

Ethereum 2.0 transition to Proof-of-Stake

The transition to PoS will occur in phases over several years. Phase 0, however, already enables staking on Ethereum 2.0 on the so-called “Beacon Chain”. This is a blockchain that runs in parallel to the current Ethereum (1.0) Chain.

The Beacon Chain from phase 0 went live on December 1, 2020. Everyone now has the option to send 32 ETH to a special staking contract. These 32 ETH are then frozen in Ethereum 1.0 and the sender receives 32 Ethereum 2.0 ETH. They cannot be used on the old Ethereum Chain for the time being.

However, that alone is not enough to become a validator and be rewarded for it. Unlike other staking systems such as ‘Delegated Proof of Work’ staking on Ethereum is not a passive process but requires active cooperation in the form of software that every validator must run to validate transactions.

Conversely, providers that offer Ethereum Staking as a service have entered the market. That way, no active cooperation is required and even amounts lower than 32 ETH can be staked. Our recommendation for staking is Lido.

In the next phase, called “The Merge” (planned in the first half of 2022), the Ethereum Proof of Work Chain will be transferred to the Proof of Stake Chain. From that point on stakers will receive not only the newly generated ETH as return, but also the portion of the transaction fees previously received by miners, which will no longer exist. This means that the staking yield can be expected to increase significantly with “The Merge”. Due to the queue for the admission of new stakers, it might be worthwhile to already start with Ethereum staking now.

How can I stake ETH?

1. Stake by running the staking software (as beacon node or validator client) on your own or rented server.

The basic requirement for this kind of staking is 32 ETH and the execution of the Eth 2.0 validator software (client node software) on a computer that is always online. There are several providers of this node software, the most popular are:

- Prysm Client from Prysmatic Labs

- Nimbus

- Teku

- Lighthouse

The Ethereum 2.0 Launchpad guides through the multi-step process to staking on Ethereum 2.0 and requires some technical knowledge.

2. Stake by allocating to appropriate providers doing the active staking job such as exchanges.

Lido.Finance now offers staking for Ethereum 2 on their platform. This has the advantage of not having to worry about the technical implementation. Furthermore, with staking on Lido it is also possible to stake much less than the required 32 ETH.

How does Staking work with Lido?

Lido is a provider for staking protocols. For Ethereum under Proof-of-Stake, Lido provides the ability to stake Ether (ETH) without users having to worry about the complicated technical aspect of validating Ethereum blocks. The advantages are obvious:

- It is possible to stack less than 32 ETH

- No technical expertise is necessary

- ETH are staked and therefore not available, but a token stETH is given as a substitute. It has the same value as ETH. Liquidity is ensured.

Lido makes this possible through a network of professional node operators who more or less apply as technical providers for the validation of Ethereum blocks. They are rewarded with a part of the achieved Staking Rewards for their services. As a user, you give a small part of the achieved Staking Rewards to these technical service providers.

The process for staking with Lido could not be easier. Users just have to connect their wallet to the app and then deposit the desired amount. You immediately receive the equivalent in stETH and earn a return.

What is the return on staking in ETH 2.0?

The return on the staking stake depends on how many stakers will make the 32 ETH deposit and thus validate the Ethereum 2.0 beacon chain.

Assuming there are only 1 million ETH you are rewarded with approx. 5.76 ETH per year (this corresponds to a return of 18.1%).

But if 30 million ETH validate the Ethereum 2.0 chain the return is about 1 ETH (3.3%) per year.

Can I become a staker with less than 32 ETH?

Yes, with providers that take care of the technical part and offer “pooled staking” or “liquid staking”. We recommend Lido Staking here. Not only can you stake with less than 32 ETH, you also get a replacement token ‘stETH’ that is worth as much as ETH.

Are there any risks involved in Ethereum Staking?

Yes. There are two different types of penalties: reduction in staking rewards and partial loss of deposit (slashing). While the reduction in rewards is an issue even for minor problems, such as when the validator is offline, slashing is not really an issue for a normal user as it requires gross misconduct.

However, if erroneous blocks are suggested or transactions are duplicated the deposit of 32 ETH is at risk.

The biggest risk in the early days will be the uncertainty whether Ethereum 2.0 runs stably, or if any bugs or hacking attacks occur.

The fact that you can switch from Ethereum 1.0 to 2.0 but not the other way around also poses a risk.

The market will assess the risk. The higher the risk, the fewer the stakers and the higher the return.